I once was a student and the idea of saving money back then was only limited to refraining from spending during the week only to spend it on a big event in the weekend or to pay for an expensive trip at the end of the month.

Sometimes it was easier cause I was asking my father for that extra fees for events or trips. So, I didn’t consider saving seriously but had I read this article and saved money since I was a student, my future could have looked A LOT different.

To save money weekly or monthly as a student, with or without a regular income, you must know the 3 ways you can save from, understand the importance of saving money that early, and follow an 11 steps process as described below.

Content Covered Today:

Categories of students with money

There are two types of students when it comes to financial behavior or income

1- Students actively making money

These students make money through work (link to how to make money as a student topic). This could be with freelance, part-time, or full-time jobs while studying as long as it’s not affecting their education.

This is the kind of students I wish I was, but our father was believing in the idea that he worked like crazy for us to have a smoother journey.

While that was and is still noble in my view, I still wish I was taught to work earlier. I believe I would have been in a different place financially.

But I must admit also that sometimes he was okay with the idea of working in our vacations, and it was me who wasn’t ready for such experience.

2- Students with passive money

These are students who have money either from their parents each week or month or from their scholarships or grants and they just spend from.

I was this kind of student, receiving money from my parent each week and sometimes each month if I’m gone for that long. It was okay for me back then and I took it for granted.

Subconsciously I think it taught me that money will always be there. I will still receive money each month only to spend or even temporarily save to spend within the same month.

When I graduated, I faced the brutal reality that you have to work and give time, energy, and sometimes money, to have money back. It wasn’t pleasant at all.

I believe that even if you have wealthy parents, it’s still important to go out there and try earning money for yourself to have an idea of what your parents went through before you.

Also, it’s going to add to the life’s experience you have and be prepared if you had to do it due to change in circumstances.

Why is it necessary to save money as a student and not wait for later?

There’s a big fat mistaken notion out there that saving starts late when you’re adult and making money from your day job. Like I said, big fat lie.

Saving can and should be starting as early as you are in high school. In my opinion, this should be taught in school as part of improving the financial wellbeing.

Saving as early as a student adds value to your financial wellbeing. It gives you a sense of accomplishment even if you didn’t have to work for it.

Saving money is a habit and starting it when you are a student helps you build that habit at ease when there’s not that much of responsibilities.

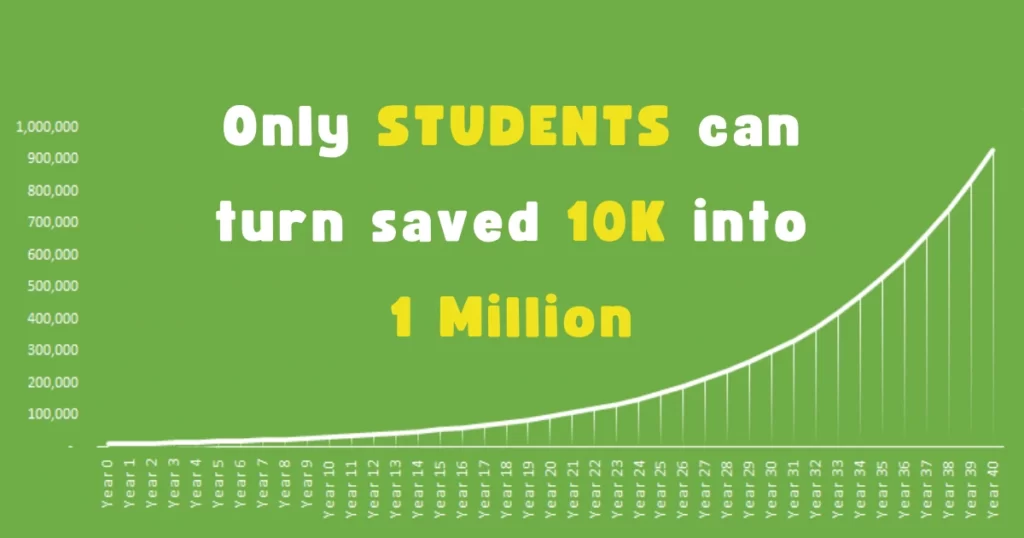

Think about how much you could have if you started saving money the right way and in a saving account or a certificate of deposit in a bank benefiting from the compound interest. It’s going to be huge.

I know that a lot of parents and teachers already breech about saving money and educate and encourage students to do so. The problem I see missing, is that saving money is one piece of the whole process. What to do with that money and how to make it increase are the other crucial pieces that have to be taught as well.

What are the ways to save money as a student?

Regardless of which category you are in as a student financially, you still have 3 ways to save money from:

1- Income

This is an obvious way only for students who actively make money while going to school or college. They get paid for their work and so they can save from it or save it all if all is extra to what they’re taking from parents or grants.

2- Selling

This is an option for both categories as all students can make money from selling things. Part of or all that money then gets saved according to budgeting

3- Cutting expenses

Another option that both categories can benefit from to kick start the saving money project. This is done through cutting down unnecessary expenses and save their money, or even playing with the necessary things strategically to save money while meeting basic needs.

Process students can follow to save money weekly and monthly

Now it’s time for the process students should follow to save money the right way:

1- Identify the purpose

You always have to start with why. Your why here shouldn’t be only about why you want to save money, but also should identify why you want to save money as a student and not wait till later.

Figuring out the purpose will make it easier for you to commit to this project and build the habit of saving money at a young age.

2- Identify your goals: long-term and short-term

You keep hearing me say this is a project, and what is a project without goals to achieve right!

After identifying your purpose(s), you should be working on assigning goals for yourself to achieve with the money you’re saving.

Those goals should include things you want to achieve on the long-run, say 10 years, and goals for the short-run, say 6 months up to a year or 2.

Long term goals can include things like, building up your emergency fund or paying your education debt. It’s good to aim for those kinds of goals to get rid of big burdens as early as possible

Short-term goals can include buying a guitar for your hobby, or a course to improve yourself, or joining a club for your exercise, etc.

The importance of having short-term goals is to keep yourself rewarded every now and then to stay motivated while saving only for the long-term goals can cause you to get bored or go after non-essential spending that have soon rewards.

3- Identify your needs and wants lists

Regardless of the way you’re going to save from, you still have to do some spending each month. If that spending isn’t regulated and maintained only for the things you really want, then you’re losing money you could have saved my friend.

To take control over your spending and feel comfortable that you’re only spending on true things, you need to identify your needs and wants lists.

Needs are the things you absolutely can’t go without during your week or month. Wants are everything else.

You need to eat, and you want to party. Even with food itself. You need to eat a healthy and traditional dinner, but you want to drink soda and eat chocolate.

4- Tweak some needs

To facilitate the saving process, sometimes it’s wiser to tweak couple of the needs that you absolutely want as a student like:

If you need a car to go to college, you can go for a used one instead of a new one. Or go for a new but small sized car rather than a big sedan car.

If you have to choose between debit cards and credit cards, always go for the debit card option to save the interest that you pay for the overdue settlement for your expenses

If you need books, you can go for used ones, or use the library, or watch videos about that subject if available.

Always prepare your meals in advance. This will help you save money that you were going to use for ordering food when you’re tired after school or college. Same goes for activities, living, and other areas

5- Make use of student’s discounts

When you cut your expenses to save money, you remove things or go for cheaper alternatives. Using students’ discounts is one of the clever ways to have cheaper alternatives for important things.

Ask for the student discounts for transportation and use it even if you’re going to have a relatively longer journey.

Same goes for other areas like food where you can have a discount, or trips that is cheaper for students, or even cheaper medical consultations for students as the one I had in my college for free.

Just do your homework, finding the areas that you can use your student discounts to save money even from the things in your Needs list.

6- Decide on the amount to save weekly or monthly

To have a successful saving money project, you must be consistent with saving each week or month. To do that, you must decide a reasonable amount of money that you can save regularly.

Once that amount is identified, you can go above it, but not below it. This is an important step of building that saving habit.

This also prevents you from doing mistakes or facing challenges that might hinder your saving progress.

7- Clarify where you’re going to save that money from

Another piece that will help you stay consistent is to identify early on, where that amount of money that you’ll save regularly is coming from.

Is it through that income you’re making each month, or through selling stuff regularly, or through stable cut in your expenses each week.

Once you do the heavy thinking about this early on, the rest is just you taking that money from that source and save it.

8- Use saving account to earn a compound interest for your savings

It’s always a good idea for students to start saving money in the bank to benefit from the compound interest over your money.

As a student it’s best to start using a saving account with a decent interest rate and the least minimum balance required or even with no minimum balance required which is available in some banks.

Not having a minimum balance required means you won’t be charged for fees if you didn’t meet that minimum balance.

Once you reach a certain milestone you can convert some or all of your saving then to a certificate of deposits to have higher interest and keep it out of your reach for years to come.

9- Use a budgeting tool

Where there’s saving, there’s spending, and maintaining a growing difference between them is healthy for your saving money project.

That’s why monitoring your income, spending, and saving becomes very important to identify areas to improve or correct.

There are many tools you can use for that including using a notebook, or apps like Andromoney, or spreadsheets.

10- Track your progress each month

This is very different from the previous point that talked about your overall expenses. Here I’m talking about tracking your progress in the saving money journey.

If the budgeting tool doesn’t have a tracking feature, then I recommend using a tool like HabitBull or any other habits tools to visualize your progress.

I also recommend doing the review monthly, reviewing your past month, and answering the following questions:

- Are you going in the right direction or not?

- Are you saving as you should be?

- Are you behind your goals? If yes, then why and what can you do to correct that?

- What are the things you’re doing good and need to maintain?

- Any improvements you think of doing next month?

11- Have your support group

I said it before, saving money is a long and exhausting task. If you’re good at it then fine, but if not, you should have a supporting group that encourages you, keeps you motivated, and holds you accountable.

You can find such support either from your close friends or through forums where you can support each other.