We all know the importance of saving money and the impact it has over our wellbeing and life, and we all want to do that.

That’s why today we’ll discuss those challenges, their causes, practical solutions for them, along with a quick plan that you can use today.

Saving money is a lifelong process that isn’t easy and has around 5 challenges you may come across during it and you have to overcome them to reap the benefits of that process. These challenges include:

- Not having an income to save from

- Having a low income that you hesitate to deduct from

- Overspending or spending on the “Wants”

- Temptations and immediate rewards

- Quitting soon or frequent

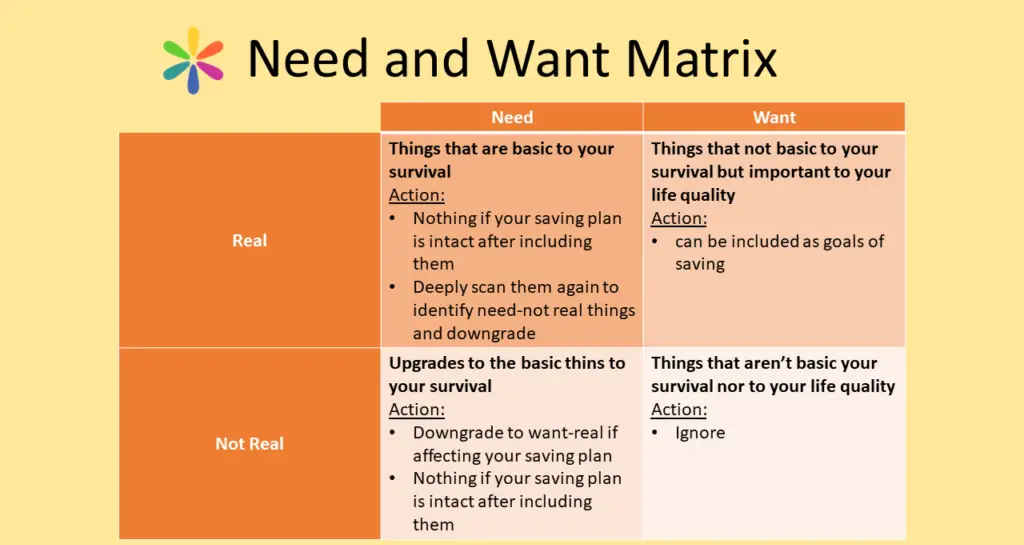

First, I want to explain an important matrix, the needs and wants matrix, to better understand how to justify your spending and the important levels you need to focus on first.

Content Covered Today:

Needs and Wants Matrix

The above 2X2 matrix explains my classification to the needs and wants and their subsequent levels.

The needs are anything that is considered important to you and your survival. The wants are anything that you can live without, but you identify as important to have.

But we can go even more specific as per the needs-wants matrix levels.

Levels of Needs-Wants Matrix

First level: Needs-Real

Those are the things basic to your survival. It includes things like essential food, home rent, electricity, and water bills.

Second level: Needs-Not Real.

Those are upgrades to your basic survival list. It includes things like preferred food, uncontrolled usage of electricity or water, or riding a taxi instead of a bus.

Third level: Wants-Real.

Those are the things that add to your wellbeing and life’s quality like pursuing hobbies for your emotional wellbeing, or upgrading accounts for productivity, or hiring a private coach, etc.

Fourth level: Wants-Not Real.

Those are the things that aren’t basic to your survival nor add to your wellbeing and life’s quality. It includes all the little things like sweets or buying what we already have, like a 3rd watch, or a 10th bag, etc.

Why you should learn this matrix?

Knowing this matrix will help you do the following:

- Understand the article better when I refer to needs-not real or wants-real levels.

- Identify your own needs and wants levels

- Save money easier by identifying the things you can get rid of without affecting your life or wellbeing.

How to use this matrix?

Simply draw your own table as above and start filling each box with the things you relate to that level.

What do you think is needs-real for you, what are needs-not real, what are wants-real, and what are wants-not real.

Challenge 1: No income – Can’t Save at all

Reason:

Not having an income, a regular one, is a reason in itself of being challenged to save while not having money to save from. That’s not just a challenge, it’s a showstopper.

This is observed in situations like with students not making money, and adults not having a job yet and living on supporting systems.

Recommendation

In this case, the obvious recommendation is to put the saving money project on hold, and mainly focus on creating that income first.

I have explained 5 ways you can make money with, and I’m sure you can benefit from them.

If you are a student who receives money from your parents or making even small income, then you should consider the tips provided in the next section.

Challenge 2: Low income – Hesitant to save

Sometimes you can be making a regular income but the problem that it’s barely enough for your needs, not alone saving from it (check idiom/grammar)

This can cause you to postpone this project in the best scenario, or even worse, not intending to have it at all.

Reasons:

You come across this challenge is because of the following:

The commonsense symptom:

It’s about believing that you must save 10% or 15% from your income as recommended everywhere.

While those recommendations are good practices and I follow them myself, but it’s not fixated percentages. You can go lower or higher than that according to YOUR own evaluation.

The fake needs:

Sometimes you think what you spend money on is your very basic needs, but if you looked closer, you will be able to identify some of the need-not real things.

You think you’re paying for basic electricity, but after further investigation you’ll discover hours of not needed usage that leads to higher bills.

The recommendation here are:

Commit to saving

Regardless how low you think your income is. Even if it’s a $1 a month. We’re building a habit here plus that $1 will eventually increase.

Identify your basic needs

The ones that you absolutely can’t live without each month, and aim to save from what’s left, or go for it all.

When I was having what I considered a low income to save from, and after thoroughly scanning my basic needs list, I found out that there is a room for saving money after all.

Set your saving amount.

You have to come up with your magic number that you are going to save every month no matter what.

When it comes to saving money, it’s more about fixating a value that is low enough that yields profitable combined effects annually, and high enough that it doesn’t affect your basic needs.

It’s going to be hard I know, but the benefit of saving will outweigh the agony in the end, and you’ll find that you’re still surviving with the alternative choices you made.

Challenge 3: Bad Spending – Over spending or spending on unnecessary things

*(to be linked with the “how to stop spending on unnecessary things” using an anchor text like “that we discussed here” or “ we discussed in detail in another article”

In this stage you’re having a decent income that covers your needs-real things, needs-not real thins, and has a room for spending on your wants.

If you’re spending too much on unnecessary things, or if you’re spending wisely on things that you know you want and you can’t save money still, then it’s a sign that you’re spending behavior is flawed.

Reasons behind this are:

Enjoy now group:

You are one of the group that believes in the idea of spending what you have now, and what’s in tomorrow will come eventually. This is not true, and all religions are against that. You have to work to make money and you have to spend wisely to live right.

Not knowing why to save:

Some people jump directly to saving 15% of their monthly income without identifying reasons why and they end up quitting saving money, simply because it doesn’t mean anything to them, yet.

Not knowing what to save for:

Saving for the sake of it gets pointless after a while if no goals were attached to that process. it won’t make sense to save any more.

Not knowing what to save from:

Not knowing the main source or couple of sources that you will provide you with the money you’ll save is a huge reason why you might quit and delay your progress. It’s when you don’t know if you’re going to save by controlling your spending or from selling items, or from deducting some from your salary.

Recommendations here are:

Identify your purpose

Come up with purpose(s) for your saving money project. Why you want to save money? What are your reasons? The more the better.

That’s why you need to come up with reasons why to save money. It can include providing a financial security against crisis, or enabling a relaxed retirement, etc.

Identify goals of saving money.

Saving isn’t just done to accumulate money. It should have goals you desire of achieving as well.

The goals can include saving for retirement or paying mortgage debt, down to buying the guitar you want to pursue your hobby.

Even the latter isn’t an urgent necessity, but it’s a want-real thing that improves your life’s quality.

Identify your needs and wants

You have to come up with a list that has all the need-real things, the ones you can’t survive without

A list for your needs-not real things, the ones you can live without totally or temporarily if you had to

A list for your wants-real things, the ones you can live without but adds value to your wellbeing and life.

A list for your wants-not real things, the ones you can totally spare and not at all important to your wellbeing or life’s quality.

Now the game is easier, you just have to stick to the higher list and see if your saving amount is achieved.

*The saving amount for this group can be set to 10-20% of the regular income as per experts’ recommendation. If it’s not applicable from first sight, then sparing lower lists above is recommended till you reach that range. If not applicable still, then you can use same method in the “low income” section.

Challenge 4: Temptations – Going for faster rewards

It’s going to be years of saving before you have your “retirement fund” secured. It’s going to be months to couple of years before you have your emergency fund in place.

When you commit to saving money, you commit to a lifelong game that doesn’t have direct immediate rewards. That’s why you easily fall for the daily temptations around you.

Reasons behind this challenge are:

Rewards fasting:

It’s more fun to buy PlayStation 5 or the recent iPhone to feel immediate satisfaction rather than saving that money for your emergency fund that you’ll have in over 4 years maybe.

My recommendation here:

Intermittent rewards planning

While you should be aiming to save money for the essential goals you identified first, I still recommend that you can mix that list up so that you stay on track to achieve long-term goals, and short-term ones too.

Instead of planning to secure your emergency fund in 48 months, you can increase it to 54 months, and dedicate those extra 6 months to things you look forward to in between.

It can be a guitar you need for your hobby, or a course you want to learn, or a hosting service to leverage your blogging hustle.

Recharge your motivation:

Revise your purposes and goals you identified from before and add to them if it’s going to help you stay motivated.

Challenge 5: Quitting – Can’t keep doing it

Another challenge here is a combination of bad spending behavior, and weakness for temptations and delayed rewards.

The outcome is simply quitting on the whole process all together or falling out and getting back again frequently which delay achieving the goals you identified to improve your financial wellbeing.

Reasons behind this are:

All reasons mentioned in above two sections plus:

Manual saving

You have to manually deposit the cash you have to the bank and when you forget to do that or can’t do it soon, you end up having the money and eventually spending it.

No tracking:

Saving is one of the infinite games of life, and without tracking your progress, you get more vulnerable to lose faith on the whole thing.

Recommendations:

All recommendations mentioned in sections 3 and 4plus:

Automate your saving

If you have your money wired to you through the bank, then one of the advantages you have is that you can automate the process to deduct from that account and wire it to your saving account automatically each month or week.

If you take your money in cash, then ask if it can be wired to you through bank and do the above recommendation

If you can’t have your money wired through bank and only take it cash, then come up with a process to immediately deposit them into your saving account

Create your tracking process

You can’t improve what you don’t measure. You have to come up with a tracking system or use a tracking tool to help you identify your progress, areas to improve, and challenges to overcome.

You can use any money tracking tools or even habits tracking tools, and you can create your tracking system in a notebook.

You can do a monthly review to evaluate this project.

Next actions you can do today

Now it’s time for you to take serious steps in improving your financial wellbeing and you can start with the following simple tasks. You can get more depth from above discussion.