We all want to save money, but sometimes it feels impossible, right? Did you know that nearly 40% of Americans can’t cover a $400 emergency expense without borrowing?! That’s a scary stat, but it also means you’re not alone in the journey to financial security.

The good news is that you don’t need drastic lifestyle changes to see results when it comes to saving money every month. There are 14 simple and practical strategies for saving money every month to build an emergency fund, save for a dream vacation, or just gain more financial control.

Let’s dive in and start saving!

Content Covered Today:

1- Stick to a Realistic Budget

Setting goals the right way is a proven strategy to achieving them, and one of the features of setting goals right, is to set “realistic goals”. This is one of the S.M.A.R.T. approach where:

- S refers to Specific goals

- M refers to Measurable

- A refers to attainable

- R refers to realistic

- T refers to time bound

Setting budget for your month’s expenses is a goal itself and it too must be realistic. Setting too low budget will lead to overspending from the amount you already identified as “saved” so it will mess up your tracking and affect your motivation and self-confidence badly since you failed to protect your “saved” money.

Setting too high budget will affect your ability to save money each month leading to longer period to achieve your saving goals and it may ruin the whole process when you give up because you’re only saving too little and don’t see a big difference.

Of course there’s no such thing as the ideal percentage you need to spend or save each month, only common and best practices of spending between 50% to 80% and saving the rest. Personally, I do 50% spending, 25-30% saving and investing the rest.

In my coaching I do the following:

- If you can remember total spending over last year or have it written down somewhere then take the average for that year (total spending for the 12 months divided by 12)

- If you don’t have the total spending for the previous year or don’t have it written somewhere then do the following:

- Start with setting 50% of your income to all spending for 3 months time and saving the rest, and don’t set a harsh limit just yet. If you needed to spend over 50% that’s okay for now. (I’m not talking about investing yet).

- Track your spending for each month in details. How much you spent on what, when, and is it recurring or not.

- List all recurring monthly and annual payments you have to do, like rent, bills, scholarships, installments, etc. You can use your tracking list for the past 3 months to check if you captured all monthly payments you did. For the annual one you have to rely on your memory, your notes, emails, etc.

- Use that average for the following 3 months and check the average of the previous 6 months.

- Calculate all your spending over the past 3 months minus the monthly recurring payments then divide them by 3 to get an average for your “nice to have spending”.

- Calculate the total of all your obligatory payments (monthly and annually) per year, then divide them by 12 to get an average spending for you “necessary spending”.

- Add both averages from step 7 and 8 and that’s the average you can go on for the rest of the year.

- Continue to track your monthly expenses for the remaining 9 months.

- At year end, calculate the average spending MINUS the obligatory ones (monthly and annually).

At this point, having the average for a 12 months time is going to be more accurate for your situation and you can build your financial plan upon that. Meaning you can use that percentage to spend each month, and later on you can improve it by reducing it down a little bit by cutting down unnecessary spending, so that you leverage the “Saving” and the “Investing” tools in your overall financial toolkit.

At this point you’re going to save between 30% and 50% and it’s more than enough as a start. And if you think, by looking at your tracking lists, that you can further improve your savings by setting limits for discretionary spending then do it.

You can use notebooks or apps like AndroMoney, Mind or YNAB to facilitate this for you. I personally use Andromoney as it’s easier for me and with me all the time.

2- Automate Your Savings

There’s nothing more efficient to saving money than not seeing the money in the first place 😊. When your bank account tells you have $1000, your brain goes like, we have $1000 to manage and it’s easy to go soft and overspend. That’s why automating your savings makes your brain get used to the lesser number you have in your account (after the saving portion got transferred automatically) and think of it as the limit that you can’t over.

I also coach you to add one more obstacle to make it even harder to think of getting some of that saved money back by transferring or depositing the saved money into another bank account that has no debit or credit card issued and or impose fees on transactions between accounts if you wanted to wire them back to your salary/spending account.

You can do this easily digitally by setting up an automatic money wiring order from the bank you get your salary on to your saving account in the other bank. Physically you need to build the habit of immediately or soon depositing portion of the received money into your saving account.

I personally use this strategy with automating wiring money for my saving account and my stock broker to be invested and I even set a recurring stock purchases for some stocks within my broker so I receive my salary – it transfers to my broker – some of it used to purchase stocks automatically.

3- Use High-yield savings account

In the previous point, I relied on saving your money in a bank which is different from the bank you’re receiving your salary on and mostly use for spending if you’re like me. To maximize the effect of this strategy, you can use high-yield savings account rather than a low-yield one or a current account.

With this strategy, you’re not just keeping the money saved from the automatic wiring, but you’re also kind of investing it and receiving interests. Personally I do two things:

I transfer the money to a high yield saving account and gain interests on it for the money kept in it.

I purchase Cash Funds with cumulative periodic return and periodic distribution which is different from Certificates of deposits in the ability of redeeming them any day without losing any money on interests. This makes it, to me at least, an alternative to the saving account, specially since it has relatively higher interest compared to the saving account. You can check couple of examples here and here and you can look for similar cash funds in your country.

4- Saving spare change

While it’s not the ground breaking strategy that will get you your $1000 saving fund in a short time, I personally still use this strategy and coach it to others purely from a mindset perspective that if you built the habit of saving 1 dollar from your daily purchases, you will be trained to save 1000 dollar when the situation arises.

When you think about it, there are few dollars spared here and there in everyday purchases that could be saved either digitally or even physically. Physically I recommend having a dedicated box to save spared dollars or changes and comes end of month, you can deposit them with the money you’re depositing in your saving account. Digitally, you can use round-up apps like Acorns to save spare change from everyday purchases.

5- Shop Smarter with Coupons and Cashback Apps

Shopping is one of the main channels we spend money on, so it’s only logical that we need to think of ways to do it strategically to support our saving money challenge. There are couple of ways I suggest in this regard:

A- Batch your shopping

This means that you set specific number of times per month to do your shopping, like for groceries, home supplies, etc. The rationale behind this is that the waiting period between the shopping activities can, and will in most times, dial down any sudden shopping urgency and save you money.

Think about it, have you ever wanted to buy anything, then for some reason you couldn’t buy it for few weeks only to find yourself later not wanting it that much so you skip on it?! This is the same concept here.

I personally do my shopping twice a month or every two weeks, so any purchases I think I want in between these two visits I just add it to the list of the next visit to reconsider when I finalize that list few days ahead of that visit. Most of the times I find that couple of these ideas don’t seem that important anymore so I remove it from my list.

If you find yourself still wanting it, then that’s your cue that it’s needed indeed so go ahead and feel okay. Similarly, if anything pops up anytime of the month and you really identify it as urgent, go buy it and don’t wait for your next visit.

For my groceries I do them every 7-10 days to always have them fresh, and for any home appliances needed, I usually do them end of year where most deals tend to happen. You can create a similar pattern and play with it till you find your perfect spot for each spending category.

Another way this saves you money, to a lesser extent, is saving indirect finances attached to the shopping like car expenses including gasoline or parking fees for example.

B- Use coupons or cashback apps

There are apps that give you coupons or cashback when you use them or purchase through them, then you can use these coupons or cashback to spend in selected number of stores affiliated with these apps. Examples of these apps include Honey, Rakuten, or Ibotta for online and in-store purchases. You can either use these apps or check if your current apps have similar feature.

C- Discounts

Another way to shop smarter for saving money every month is benefiting from discounts for the products you’re shopping for. This is easily monitored if you’re shopping from a hypermarket that has a website or an app where you can find deals and discounts.

You can even connect this discount strategy with the batching shopping one and select those times to shop when the store is offering discounts. This is what I personally do when I discover that there are deals going on couple of days ahead or after my planned visit so I shift my visit to benefit from these discounts.

D- Points

Another way to buy products is by using points given to you by the store you’re dealing with. I found out that the hypermarket I’m using has an app that tracks my purchases and gives me points to redeem which I do every few months when I have decent amount to use.

Check if the stores, shops or hypermarkets you’re dealing with has this feature and use it to your advantage.

6- Review and Reduce Subscriptions

This is one of the easiest ways to lose money on a monthly basis without realizing until it’s too late when the impact is huge or you consciously filter your subscriptions. Everyday there are more and more opportunities for you to subscribe to an app or a service or a membership plan for a product you like. Here are few tips to improve saving money every month from your subscription’s plans:

- Go through your monthly subscriptions (streaming services, apps, memberships) and cancel anything you don’t use regularly.

- Consider downgrading plans for services you don’t fully utilize.

- If you’re paying digitally, set a notification way to inform you of any payment done for any of your subscriptions.

- Create a list to track your subscriptions using digital apps or write it down in a paper and store it properly.

- Do a monthly review to your expenses and track your spending including subscriptions products.

7- Pay Off High-Interest Debt First

Saving money is not just about putting money into your bank account, it’s also about reducing any fees taken from you repeatedly. Paying interests for credit cards and loans is the single most point you need to consider here using any or all of the following strategies:

- Focus on paying off credit cards and loans with the highest interest rates.

- Consider consolidating your debt to lower your monthly payments.

- Use the debt snowball method to tackle smaller debts first and build momentum.

8- Eliminate Unnecessary fees and fines

Why people pay $1200 on a $1100 bill? It’s because they failed to pay that bill or renew their subscriptions in time so they had to pay more for the fines. This is an easy way you lose money that you could have saved easily by using one or more of the following techniques:

Set automatic renewals for digital products or subscriptions provided that your balance is always funded. If needed, you can set an automatic transfer from your salary to this balance if possible. This way your balance is always enough for the automatic renewals needed.

Set reminders on your calendar for the recurring bills or payments needed if they don’t have automatic renewal feature, like monthly installments or credit card fees or electricity bill or driver’s license for example. This way you can anticipate required payments ahead of time and avoid penalties.

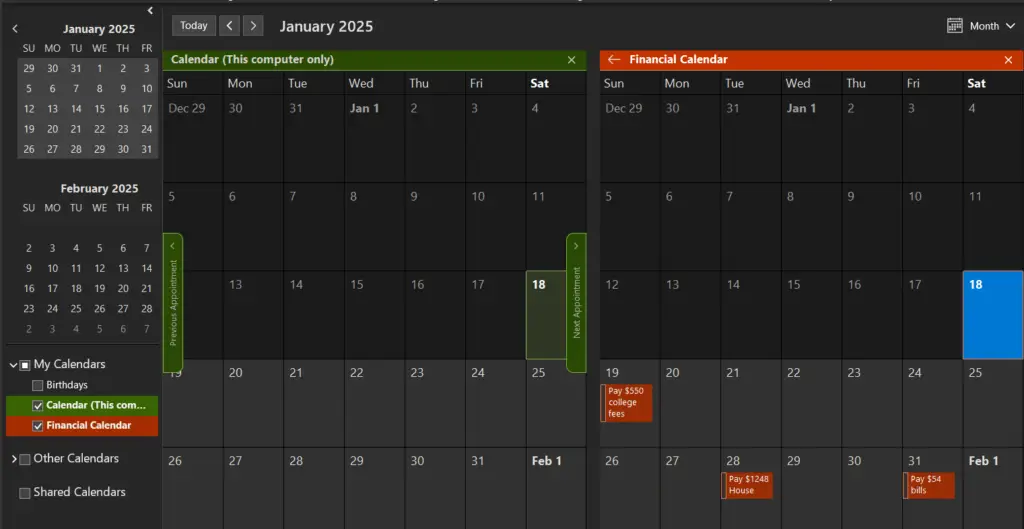

One solution I advised one member, who had a lot of finances to handle and adding due dates on the primary calendar was unproductive for him, was to create a separate calendar called “Financial Calendar” so that he adds whatever deadlines to it, only checks it in his weekly review, then only adds the tasks related to payments need to happen in the following week in his primary calendar.

9- Negotiate Bills and Expenses

Negotiation is one of the undermined and underused tools that can easily save money just by using one sentence like, “is it impossible to have a discounted price?” or “How can I afford that giving my situation?”. It’s not going to always work but sometimes it will. One of the essential books about negotiation I read recently is “Never Split The Difference” by Chris Voss so check it out for effective negotiation strategies.

10- Cut Down on Energy Costs

Using same concept as above of reducing any fees taken from you repeatedly, you can consider lowering down your bills by living smartly using any or all of the following strategies:

1- Invest in energy-efficient light bulbs and appliances to lower utility bills.

2- Unplug electronics when not in use to avoid phantom energy usage.

3- Adjust your thermostat by a few degrees to save on heating and cooling costs.

11- Plan Meals and Avoid Impulse Buys

There’s a major opportunity for improving your saving money exercise if you noticed that you spend money on buying meals frequently which tends to have higher cost than preparing them at home. While preparing and cooking the meal might seem heavy, there are couple of benefits for eating at home when it comes to saving money:

- It will be cheaper than buying meals so you’ll save more

- When you buy your groceries and do your shopping few times a month when there’s deals or discounts or you have points, you’ll save more money.

Here are few actions you can take in this regard:

1- Create a weekly meal plan to avoid last-minute takeout.

2- Buy groceries in bulk to save on per-unit costs.

3- Stick to your shopping list and avoid impulse buys at the store.

12- Use a 30-Day Rule for Big Purchases

As mentioned earlier, waiting before buying can reveal if the purchase desire is real or not. If it’s saving you money on the small purchases, then it will definitely save more on the big purchases like home appliances for example.

One of my recent big purchases was a 65” TV and I followed the same concept. My wife and I decided we need one in August or September, and we know that in November there are white Fridays deals and in December there are huge deals in one of the big stores, so we decided that to reconsider this decision again comes November, so that if we still want it we buy it and on sale. We bought it with 31% discounted price.

13- Carpool or Use Public Transportation

If you’re driving then you are technically married to it, and just like marriage, you need to fulfill your car’s needs including gas, parking, and maintenance. There are few ways you can save money spent on your car:

1- Use carpooling with coworkers or friends to save on gas, parking, and maintenance

2- Use public transportation where possible or walk or bike for shorter trips.

3- Look into ride-sharing apps or programs that offer discounts on commutes.

14- Declutter and Sell Unused Items

This is not exactly a direct saving money strategy and it seems more of a making money tool so I kept it at last, but it might work from the angle that you’re selling unused items in a good condition before it breaks down or deteriorate and lose money value. You can do the following:

1- Go through your home and gather items you no longer need or use.

2- Sell your unwanted items on platforms like Facebook Marketplace, eBay, or OfferUp.

Conclusion

Saving money every month doesn’t have to be a struggle. By making small but consistent changes—like budgeting, cutting unnecessary expenses, and being smarter about your purchases—you can build your savings without feeling deprived. These 14 strategies are simple, effective, and easy to start today. You need to realize also that it’s more important to focus on building the saving money habit rather than the amount you’re actually saving so don’t underestimate the cent or dollar you’re saving. You’re building a habit.